The process of independently monitoring and investigating – internally or externally – the operations and activities of a government agency, company or civil society organisation to ensure accountability and efficient use of resources.

Offshore financial centres

Countries or jurisdictions, some times called ‘fiscal paradises’ or ‘tax havens’, that provide financial services to non-residents on a disproportionate scale to the domestic economy as a result of financial incentives, such as minimum government interference and very low or zero tax rates.

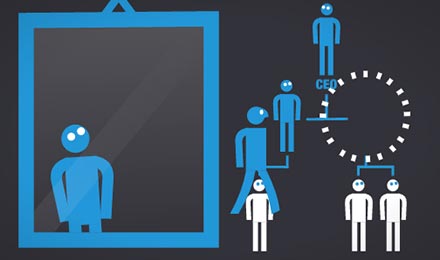

Nominee (Nominee Director / Nominee Owner / Nominee Shareholder, etc)

Nominees act as the legal manager, owner or shareholder of limited companies or assets. They act on behalf of the real manager, owner or shareholder of these entities. These nominees obscure the reality of who is really operating or benefiting from the company and are often used when the beneficial owners do not wish to disclose their identity or role in the company. Professional nominees are paid a fee for their services but otherwise have no interest in the transactions. Nominees could also be family members or friends. Often, nominees pre-sign documentation, such as letters of resignation, which the beneficial owner can choose to effect at any time.

Nepotism

Form of favouritism based on acquaintances and familiar relationships whereby someone in an official position exploits his or her power and authority to provide a job or favour to a family member or friend, even though he or she may not be qualified or deserving. Also see ‘clientelism’.

National Integrity Systems

A holistic approach to analyse both the extent and causes of corruption in a particular country by looking at the system of checks and balances and institutional pillars that form a society, including the executive, legislature, judiciary, ombudsman, media, civil society and business sector. Developed by Transparency International, this framework is useful for evaluating a country’s institutional strengths and weaknesses and developing an anti-corruption strategy.

Mutual legal assistance (MLA)

Mutual Legal Assistance is the formal process of cooperation between two or more jurisdictions, for example on cross-border money laundering, asset recovery and tax evasion cases. Through this cooperation, which is usually enacted through a treaty, a state can ask for and receive assistance in gathering information and evidence from private and public sources for use in official investigations and prosecutions.

Money laundering

Lobbying

Know your customer

Know Your Customer (KYC) is a term used to describe a set of money laundering measures normally mandated by law which are employed by banks and other financial services to document the true identity of a customer/client and his or her source of wealth to make sure it is legitimate. The KYC information is compiled and retained in a client “profile” that is periodically updated. Actual activity over the account is compared to the KYC profile to identify activity that raises suspicions of money laundering.

Integrity

Behaviours and actions consistent with a set of moral or ethical principles and standards, embraced by individuals as well as institutions, that create a barrier to corruption. See ‘ethics’.